Who We Were

2002-2004

The Veld Group is a full-service Business Brokerage that assists Main Street business owners with their Valuation, Exit Planning and Business Merger or Sale needs. After launching in 2002, the Los Angeles based company established a presence in Las Vegas, San Diego and Tokyo, Japan. The company’s founding members have been a team since 1986, when they first came together as altar boys and went on to play football at Bishop Gorman High School.

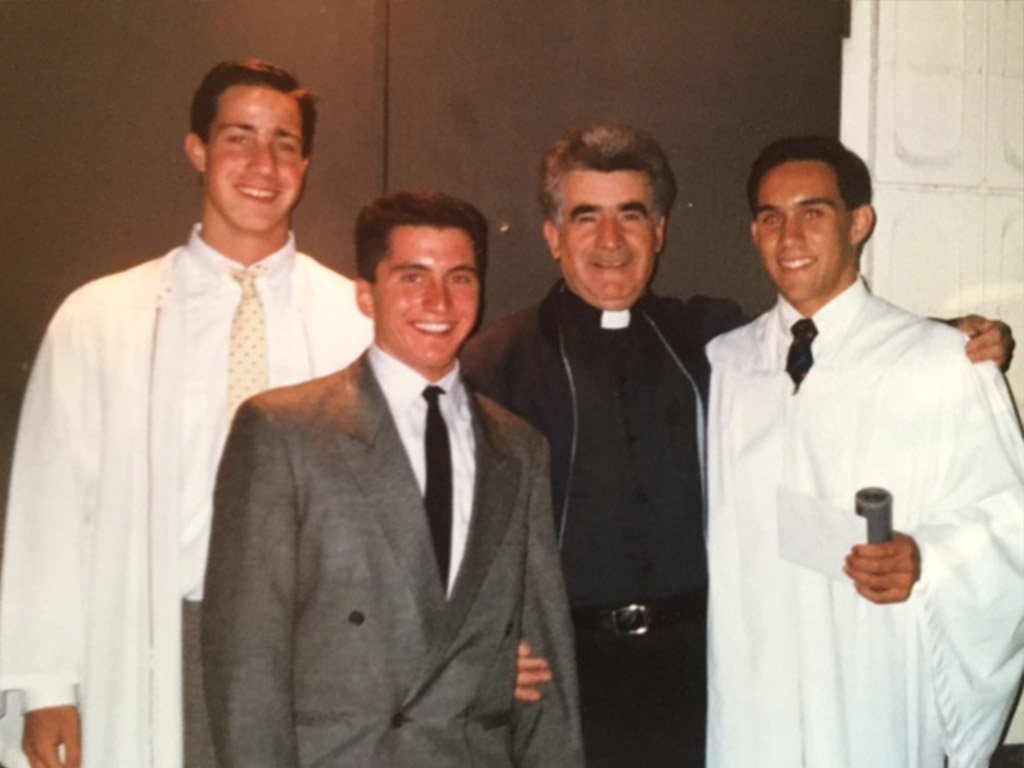

1985 St. Anne’s Altar Boys

R Rodriguez & M Wildeveld

1987 St. Anne’s Confirmation

M Wildeveld, R Clark & R Rodriguez

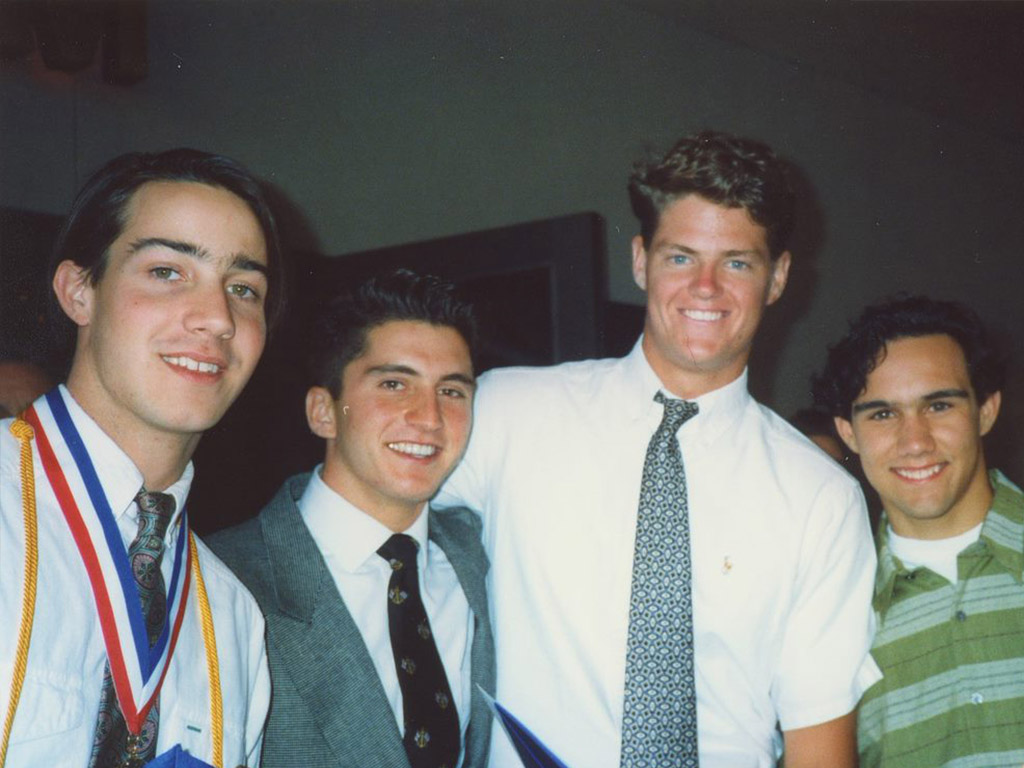

1990 Bishop Gorman HS Graduation

M Wildeveld, R Clark, J Harris & R Rodriguez

The company set out to provide retainer-based consulting services to business doing sub $20M in gross revenues. Its concept was to provide an innovative retainer-based Board of Directory style advisory service carried out by an assemblage of 125 recent MBA graduates from top tier programs. Veld was confident that the uncommon, shared risk business model coupled with providing the passionate talent to implement the initiatives developed would be welcomed by the target client base as a refreshing results driven alternative to consultants who were paid in advance to merely delivery a report. The long-term vision was to cultivate a group of savvy operators that would be matched with participating owners that could leverage the talent pool to achieve results beyond their own abilities and bandwidth. An additional benefit was that these leaders could expand the client’s succession option should they elected to scale-down or even retire.

To accomplish the vision, The Veld Group targeted firms in fragmented industries poised for consolation. These initially included commercial printing, food manufacturing, and health and beauty care products and services. The concept failed as it turned out that veteran owners tended to not embrace implementing the strategic initiatives or if they did, they opted for what were perceived to be less risky half-measures. The silver lining of the exercise was that The Veld Group initially recognized an unmet client need for credentialled valuation work and pivoted to focus on valuation work that met clients where their needs were – which was in scaled down versions of the more formal, longer format and unnecessarily costly certified valuations.

Shortly after Veld team members became certified in Valuation work, they recognized another unmet market need. In several cases, their valuation clients went to market with dismal results. The team conducted a market analysis and discovered several reasons for this. The leading causes were a fragmented brokerage industry that either focused on smaller Main Street Opportunities or only larger $50M plus Lower Middle-Market enterprises. The smaller business brokerages that catered to smaller sales employed commercial real estate style tactics to market and sell a business, with little to no pre-planning, client and business preparation, company value assessments occurring, protections in place to ensure confidentiality is maintained or buyer outreach systems and sufficient qualifying mechanisms in place. Conversely, Mergers and Acquisitions firms had little interest in smaller opportunities and lacked an individual or small private company buyer pool. What’s more, while they may assist in capital raises on larger deals, they were wholly unfamiliar with obtaining financing for smaller deals or structuring sales for smaller business owners that would align with their concerns and alleviate the fears they possessed regarding a transition. Put simply, clients in the $1M – $5M EBITDA range were too large for the main street marketplace and too small for lower middle-market mergers & acquisitions and boutique investment banks to sufficiently cater or have an interest in. The team set out to tackle both distinct marketplaces, but most importantly, learn the nuances of how to help those clients in what they began to refer to as “No Man’s Land.” Their former consulting and valuation patrons that had not successfully transitions became their first clients.

Who We Became

2004-2014

As a result of its success rates when they brought former consulting and valuation clients to market, The Veld Group shifted their focus to brokerage activities. They developed a system that took a more comprehensive approach to analyzing each client’s company, assessing its value and untapped potential, and preparing it (and the seller) for a transition in a more effective manner. As in the past, they championed a success-based pricing strategy that shifted the risk away from the client.

The system that was put into practice leveraged The Veld Group’s core team member’s complementary skill sets with truly remarkable result. The team achieved an 82% success rate when taking clients to market – nearly three times the industry’s 30% average. It also resulted in an 8.2 month average time to close after a representation agreement is executed, which is 15% sooner than that industry’s 9.5 month average. Finally, once a transaction is under a Letter of Intent or Purchase Contract, it has a 90% assurance of close, as compared to the 50% – 60% probability is not uncommon. The system not only proved invaluable for outright sales, but it also created a highly conducive environment for clients to entertain strategic partnerships, formal mergers, or to grow by acquisition prior to going to market.

The success that Veld achieved with strategic mergers early on mergers and sales led it to orchestrating roll-ups in the commercial printing, food manufacturing and beauty care industries. In almost every instance, the strategy was to provide sellers a seamless exit or participation in a future exit at a higher valuation, while bolstering performance for the ongoing entity to achieve a more attractive valuation multiple in a downline sale.

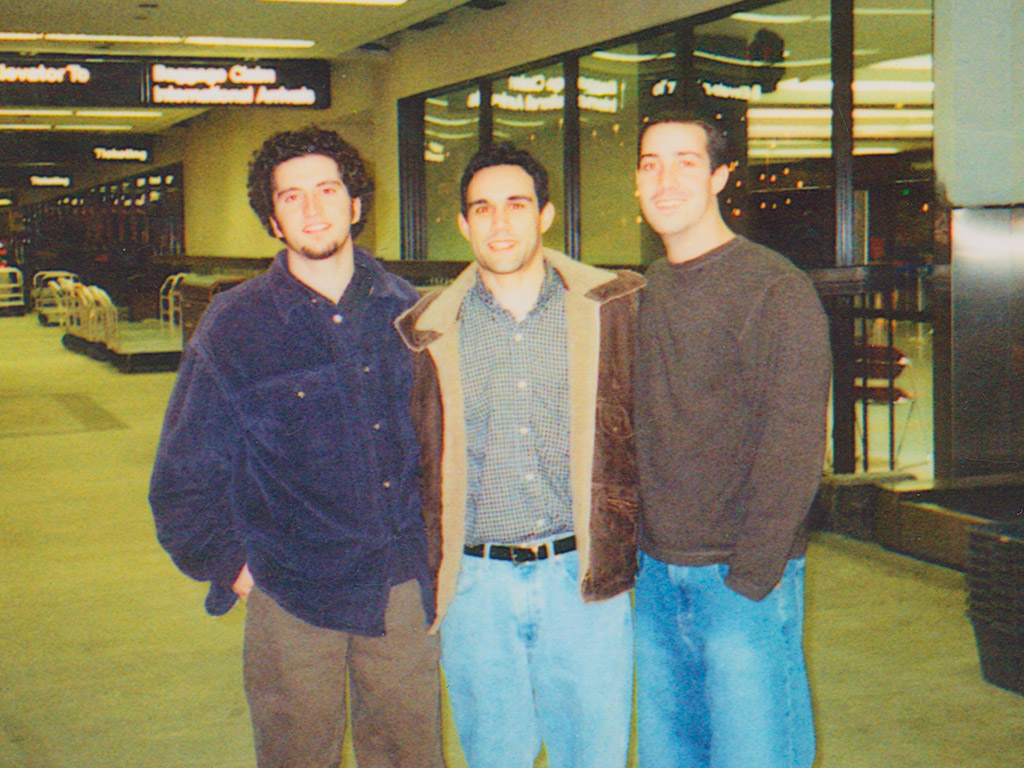

1997 LAX Airport Pick-up

R Clark, R Rodriguez & M Wildeveld

2012 Golf Tournament Sponsorship Malibu

R Rodriguez, R Clark & M Wildeveld

R Rodriguez, M Wildeveld, V. Tuchinsky & R Clark

Who We Are

2015-2022

Despite its nimble size The Veld Group, together with its sister company Veld Mergers & Acquisitions, has become one of the most prolific business brokerages in the country in terms of productivity. The combined firms have orchestrated over 1,000 transactions in the $0 to $50M size range. Although the two largely cater to distinct buyer pools (i.e. individual owner-operators and investors for main street companies, versus corporate, private equity owned, or public companies for larger concerns), the companies complement one another remarkably well. The Veld Directors attribute this to the parallel approach that each takes on the opportunities they represent and the overlap in ownership and investors that exist.

“More often than not, we find that we are working with a client that wants to divest locations or a division, but that allows us to interface with the parent company that has their own growth via acquisition strategy. Working on a portion of their operation on a smaller deal exposes us to the additional merger, acquisition or strategic partnership opportunities that also make sense. Without having taken on the smaller deals, we would not have become part of the larger ones,” cites Ryan Clark. “Similarly, entrepreneurs are serial business owners and investors. Many often have more than 1 business. We may transact on a sub $1M deal for a client that later wants to sell or acquire a multimillion concern. We are highly active in both marketplaces, and despite what outside observers often assume, we don’t focus our efforts on the larger deals. In fact, although smaller deals require more effort and introduce an array of unanticipated challenges, we simply work our system that we know will deliver results. There is no size criteria or threshold for this. If we did introduce some form of anticipated net benefit requirement for each engagement, it would likely throw our “flow” off. The entire team is full speed ahead on every project. Associated success fees really are an afterthought.”

2015 R Rodriguez Wedding

R Clark & R Rodriguez

2017 LA Business Journal Shoot

R Clark, M Wildeveld & R Rodriguez

2023 Corporate Video Shoot

M Wildeveld, R Rodriguez & R Clark

Who We Will Become

2023 +

Due to West Hollywood’s shelter in place mandate as a result of COVID, The Veld Group closed its beloved Sunset Strip office of 20 years. As a result, it adapted to a remote working environment. Migrating to a cloud-based computing and phone environment inspired us to embrace sourcing intermediaries, professional valuator and support services talent from the global marketplace. Where we once encountered resource limitations for ever growing client base, we now enjoy an abundance of solutions with few of our former constraints.

As all business owners encountered during the COVID years, slight operational changes and mindset shifts require innovation. As a result of the lockdowns, The Veld Group was inspired to develop a highly scalable version of the ‘system’ it established in 2004, in order to assist a far greater number of clients despite social distancing requirements or disparate geographies. The next iteration of The Veld Group’s system, which has been proven over the past 20 years and refined by over 1,000 transactions, will work regardless of real or perceived geographic limitations that may have been viewed as impediments in the past. The new and improved 2023+ version of this will not only allow The Veld Group to expand its geographic practice area, but it will also bolster the scope of its service offerings in an even more cost-effective manner. As of early 2023, the company has begun to make this a reality. The Veld Group and Veld Mergers & Acquisitions looks forward to seeing with the journey collectively takes them.